We focus on sustainable and

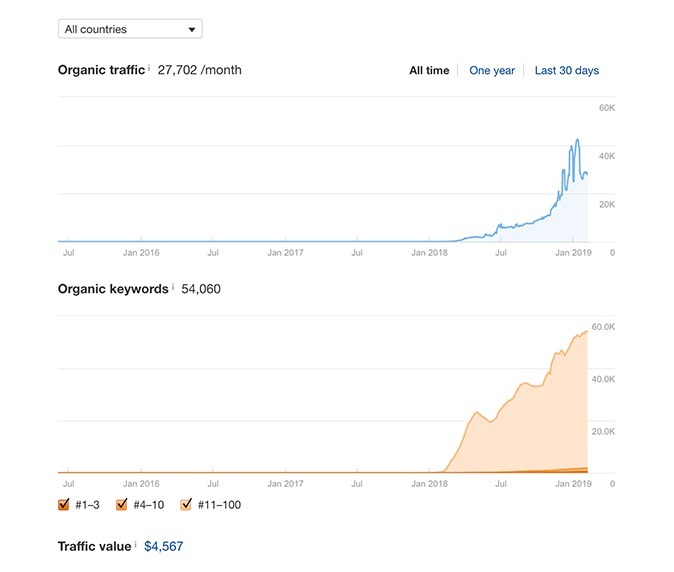

long-lasting growth

We have 20+ years of combined

SEO experience

We have a proven track record of

real quantifiable results

100+ websites ranked across multiple industries

We prioritize transparency and

timely communication

We offer zero commitement

month-to-month contracts.

We have over three decades of combined SEO experience

200+ websites ranked across multiple industries

©2025 Keever SEO. All rights reserved.